These dividends, just like short-term capital gains, are taxed as ordinary income.Ģ019 tax rates: Long-term capital gains (LTCG) and Qualified dividend income (QDI) LTCG and QDI tax ratesĢ020 tax rates: Long-term capital gains (LTCG) and Qualified dividend income (QDI) LTCG and QDI tax rates

#CAPITAL GAINS TAX BRACKETS 2020 FULL#

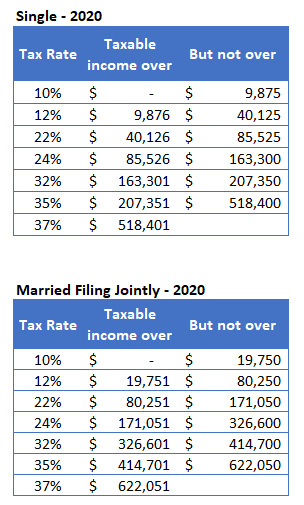

Want to dig deeper on the math here? Check out our tax brackets article for a full explanation. To calculate your effective tax rate, you’d divide the total amount of tax paid for each income range by the total amount of taxable income. Using the example above, we know not all your income would be taxed at 22%. Effective tax rate – This is the percentage of total tax paid on all your income.That said, your marginal tax rate would be 22%. Most of your income would fall in the 0%, 10% and 12% ranges, but the very last of your income would fall in the 22% range. For example, let’s say you file Single and your taxable income is $50,000. The marginal tax rate can be different from one person to the next based on their filing status and the amount of taxable income they have. Marginal tax rate – This is the tax rate paid on the next dollar of income.

Among sources of other income are business income, farm income, rental real estate, alimony, unemployment compensation and nonqualified dividends.Īnother callout helpful in explaining federal tax income tax rates is understanding the difference between two terms - marginal tax rate and effective tax rate. Examples of ordinary income include salaries and wages, interest earned, income from self-employment and taxable IRA distributions. One note for federal income tax rates is that they apply to ordinary income.

To see the 20 tax rates and income ranges, check out this article where we outline what the current tax brackets are. Most taxpayers are familiar with this concept - You typically see these percentages represented with a table along with ranges of income. Federal income tax ratesįirst let’s talk about federal income tax rates. Not sure which one? Don’t worry! We’ll outline the types of tax rates and the situations when you’ll encounter them in this post. Is it the capital gains tax rate, marginal tax rate, or the withholding tax rate on bonuses (what some people think of as a “bonus tax rate”) you’re looking for? When someone asks about the current tax rates, they could be referring to a number of different types of tax rates. The question of tax rates is no different. Tax questions often have complex answers.

0 kommentar(er)

0 kommentar(er)